NEWS

2022 budget: Self-employed people should be taxed- Rep

A House of Representatives member has called on the Federal Government to tax self-employed Nigerians because they allegedly make lots of money.

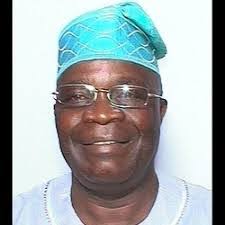

Hon. Olufemi Fakeye, a lawmaker representing Boluwaduro/Ifedayo/Ila federal constituency of Osun States said this during plenary session on Wednesday while commenting on the 2022 budget.

Fakeye said taxing self-employed citizen would enable the federal government to boost its revenue.

“I’m aware right now and it has been said here that only two quarterly releases have been made now, we are in the last quarter of the year. That makes a joke of all the effort that we put in day in, day out to ensure that the budget is passed on time”, he said.

Read also: 2022 budget: Lawan concerned with budget funding, amid high debt rate.

“I pay attention to revenue shortfalls for the government. I recall when I was young, everybody paid taxes. Whether you are a farmer, your daddy was a carpenter, whatever he did for a living, he paid tax.

“Now we have tended to forgive everybody their taxation except those who have an income where the tax is taken out of your income and the rest paid to you.

“I think our tax reform should be such that every Nigerian has a chance to contribute. Go out there and talk to 80 per cent or 90 per cent of the people of Nigeria, a lot of them who are self-employed; they don’t pay tax anymore.”

“So when we hear the Federal Inland Revenue Service or tax organisations, or even the tax joint boards are widening the tax net, why do they shy away from finding a way to make people pay — whether you are a carpenter, taxi driver, you are selling rice in the market or not. These people make a lot of money but they don’t get to pay anything. So I think that is an area I would like to see revenue-boosting,” he added.

Read full article on Punchng.