NEWS

El Salvador Boosts Technology Sector, Eliminates Taxes On Technology Innovations

El Salvador has made a bold move to boost its technology sector by eliminating all taxes on technology innovations, including software programming, coding, apps, and AI development.

This move is expected to attract more investment and encourage local entrepreneurs to build innovative technology solutions.

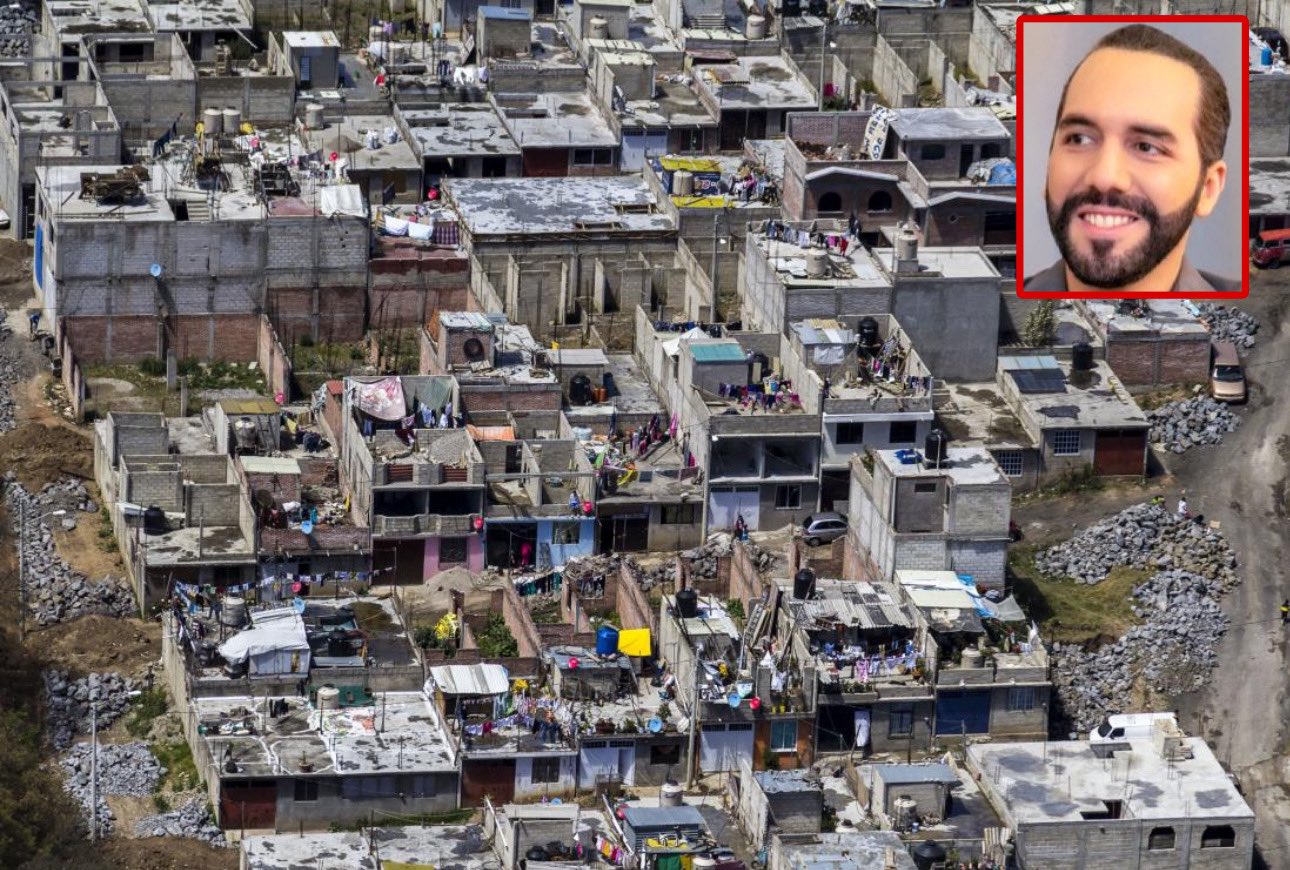

The decision to eliminate taxes on technology innovations was announced by the President of El Salvador, who emphasized the importance of supporting the technology industry in the country.

The President said that the government is committed to creating a favorable environment for technology businesses to thrive and contribute to the country’s economic growth.

This move is significant because it will not only benefit technology companies but also create job opportunities for young people with expertise in technology.

With the elimination of taxes on technology innovations, more technology companies are expected to set up their operations in El Salvador, which will create more jobs and boost the country’s economy.

The decision has been welcomed by the technology industry in El Salvador, with many expressing their appreciation for the government’s support. They believe that this move will help the country’s technology industry compete on a global scale and attract more investment to the country.

In conclusion, El Salvador’s decision to eliminate taxes on technology innovations is a game-changer for the technology industry in the country.

This move will create more job opportunities and attract more investment to the country. It remains to be seen how this move will impact the technology industry in El Salvador, but it is clear that the government is committed to supporting the growth of this industry.