NEWS

CBN plans bank mergers, recapitalisation as capital base weakens by $3.5bn

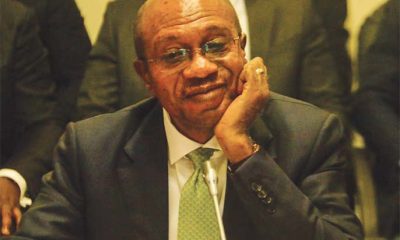

The governor of the Central Bank of Nigeria, Godwin Emefiele has revealed plans to carry out a recapitalisation exercise for deposit money banks in the country, TOPNAIJA.NG reports.

Emefiele made this known on Monday while unveiling the five-year plan of the bank.

Bank recapitalization is the act of changing the capital structure of a bank to provide more equity funds to meet the bank’s long-term financing needs to ensure the security of shareholders fund.

In July 2004, the CBN announced the recapitalization of the banking sector from N2 billion to N25 billion with effect from December 31, 2005.

This led to the reduction in the number of banks to 24 from 89.

“We will continue to improve our on-site and off-site supervision of all financial institutions while leveraging on data analytics and our in-house experts across different sectors to improve our ability to identify potential risks to the financial system as well as risks to individual banks,” he said.

“In the next five years, we intend to pursue a programme of recapitalising the Nigerian banking industry so as to position Nigerian banks among the top 500 in the world.

“Banks will, therefore, be required to maintain a high level of capital as well as liquid assets in order to reduce the impact of an economic crisis on the financial system. With a rise in digital payment and cybersecurity threats.”

According to Emefiele, the apex bank will continue to defend the naira within the next five years as there are no plans to float the naira.

He said this would “reduce the impact that exchange rate volatility could have on our economy”.