Business

Nigerian student in UK loses N2.2 million in UBA account fraud

In an alarming case of financial fraud, Bamidele Dayo, a Nigerian student pursuing a master’s degree in the United Kingdom, found himself the victim of a mysterious and devastating bank theft involving the United Bank for Africa (UBA).

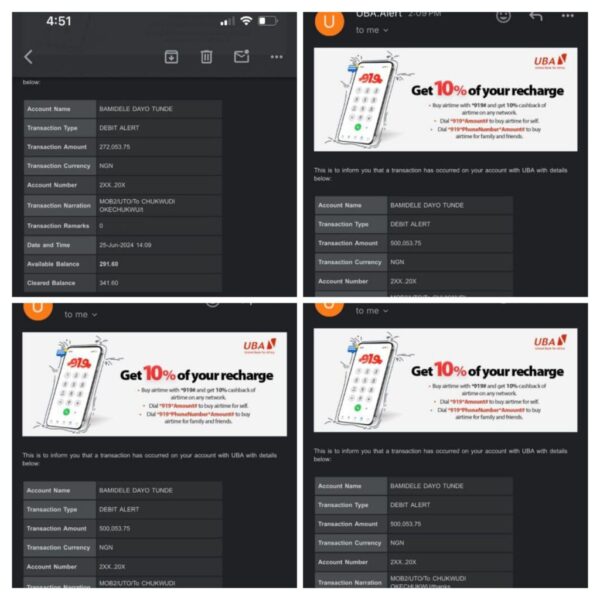

On June 25, Dayo initiated a routine transfer of N10,000 from his United Bank for Africa (UBA) account. However, within moments, his phone was flooded with unusual debit alerts totalling N2.272 million. The transactions included four separate withdrawals of N500,000 each, plus an additional N272,000.

Stunned by the sudden loss, Dayo immediately contacted UBA to report the unauthorized transactions. Despite his prompt action, UBA’s forensic investigation failed to trace how his money was siphoned off, leaving the young student in a precarious financial situation.

Read Also:

Ex-Kansas Bank CEO sentenced to 24 years for $47M cryptocurrency fraud

Critical corruption case files stolen in Kano court vandalism

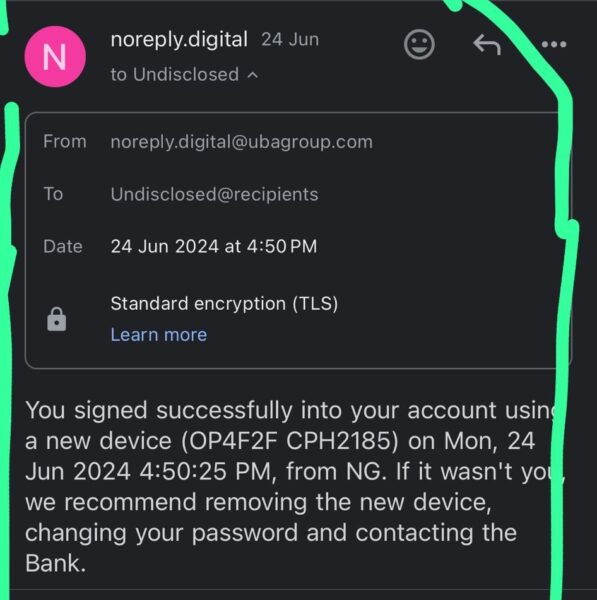

In an interview with FIJ, Dayo recounted the bewildering sequence of events. He received an email notification indicating that a new phone had been linked to his UBA mobile app—a shock, considering he had not shared his phone or account details with anyone.

Even more troubling, Dayo could still access his account, yet another device had simultaneously gained access without triggering the usual security protocols, such as a one-time password (OTP).

“I could log in, yet someone somewhere in Nigeria could still log in on the same mobile app. I wondered how two mobile devices could be attached to one account without me getting an OTP,” Dayo told FIJ. The unauthorized transfers were made through a mobile app linked to his account, further deepening the mystery.

The email alert about a newly linked device from Nigeria

A minute after a N10,000 transaction, Dayo got a series of strange debit alerts on his phone: N500,000 in four places and an extra N272,000!

Dayo promptly reached out to UBA’s fraud help desk, where he was informed that his account would be locked for a forensic investigation. However, the bank’s investigation yielded unsatisfactory results.

According to Dayo, the forensic report excluded the newly linked app that had been used to execute the fraudulent transactions, making it impossible to trace the origin of the theft.

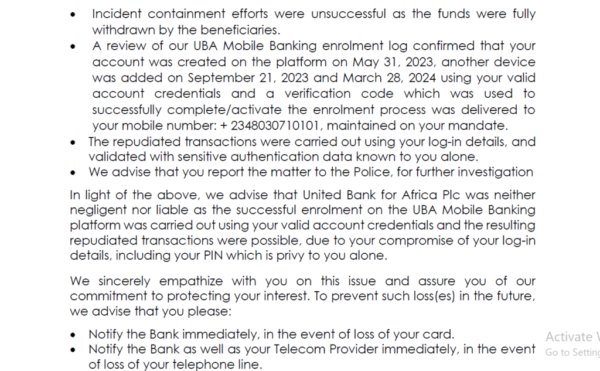

UBA’s forensic report stated that the disputed transactions were carried out using Dayo’s login credentials and “validated with sensitive authentication data” known only to him. The report also noted that his account had been accessed via different devices on May 31, September 21, and March 28, all verified by OTPs sent to his phone.

However, Dayo was adamant that the device used in the theft did not follow the same verification process, as no OTP was sent to him.

UBA’s forensic report

“The money was sent to a Moniepoint account,” Dayo revealed, adding that the loss had severely impacted his ability to pay tuition, forcing him to take out a loan.

Frustrated by the lack of progress, Dayo sought legal assistance. His lawyer reached out to UBA, prompting the bank to promise a fresh investigation starting on July 1. However, when no response was received by the end of July, a reminder was sent on August 8. It was only then that UBA provided a letter dated July 18, which repeated the initial findings without offering any new information.

FIJ attempted to contact UBA for clarification, but the bank merely directed them to communicate with the affected customer, offering no further assistance or resolution.

This case raises serious concerns about the security measures in place at UBA and the challenges faced by customers seeking redress after falling victim to sophisticated financial fraud. As Dayo continues to grapple with the repercussions of the theft, the incident serves as a stark reminder of the vulnerabilities in the digital banking landscape.