NEWS

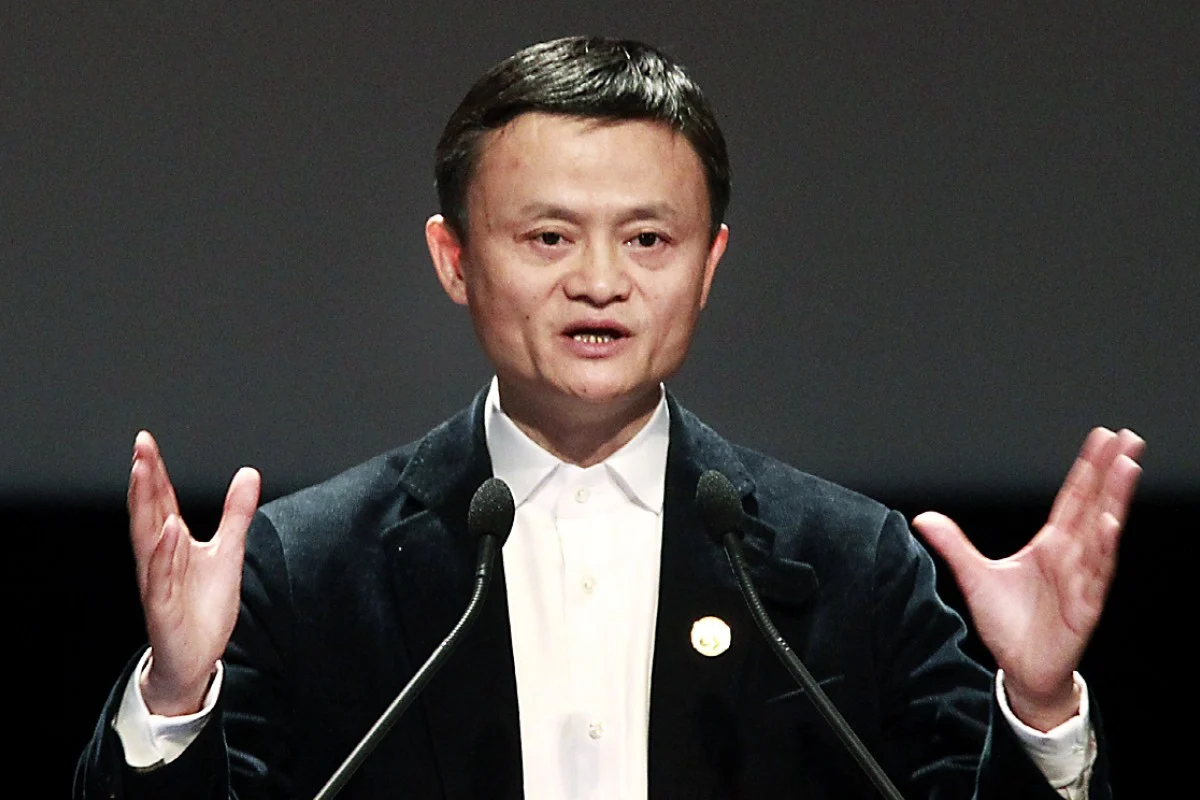

Jack Ma’s rare memo backs Alibaba’s restructuring efforts

In a surprising move, Jack Ma, co-founder of Alibaba, penned a lengthy memo expressing backing for the internet giant’s restructuring endeavours. This marks a rare return to the spotlight for Ma after years of keeping a low profile.

Alibaba’s Hong Kong-listed shares saw a notable 5% surge following the dissemination of the memo among employees.

The post, shared on an internal company forum, comes one year after Alibaba announces a significant decision to split into six units – the largest restructuring move in its 25-year history.

Since the restructuring announcement, Alibaba has encountered a series of challenges, including the appointment of a new CEO, as well as the initiation and subsequent abandonment of listings for its cloud and logistics units.

Additionally, it faced increased competition in the e-commerce sector from lower-cost rivals such as PDD Holdings and Douyin, the Chinese counterpart of TikTok.

In the memo, spanning roughly a page, Ma commended the leadership of CEO Eddie Wu and Chairman Joe Tsai. He highlighted how the division into six units had streamlined decision-making processes, rendering Alibaba more adaptable and customer-centric.

Acknowledging past missteps, Ma emphasized the importance of promptly admitting and rectifying previous errors while undertaking reforms for the future.

He lauded the resilience of the Alibaba team amid internal and external doubts and pressures faced by the company throughout the year.

Notably, the memo marks Ma’s lengthiest communication on Alibaba’s intranet in five years, reflecting his approximately 4% ownership stake in the company. At the time of reporting, Alibaba had not responded to requests for comment on the memo.

Industry observers, including Jacob Cooke, CEO of WPIC Marketing + Technologies, view the memo as an effort to bolster confidence in Alibaba’s leadership amidst increasing scepticism.

The company’s shares have experienced a 27% decline in the past year, resulting in a market capitalization of around $178 billion.

Ma’s public critique of Chinese regulators in 2020, which led to the derailment of a significant listing by fintech company Ant Group, preceded regulatory crackdowns on the Chinese tech sector, including a hefty fine of $2.8 billion imposed on Alibaba.

Since then, Ma has largely retreated from public life, dedicating much of his time to activities abroad, particularly in Japan, where he serves as a visiting professor at Tokyo College.