NEWS

The Hottest Property Market in the World – How to Invest and Make Money in Real Estate in Africa

How to invest and make money in real estate in Africa? You’re about to find out…

Just like food, water and clothing, shelter is one of the most basic human needs everywhere in the world. It would be nearly impossible to survive on this earth without a roof over your head. Everybody needs a home – a place that provides protection from harm and the weather; a warm room to sleep and live in.

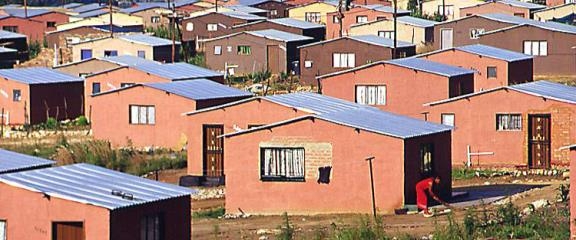

Despite the huge importance of shelter, Africa currently faces a serious housing crisis. The shortage of suitable accommodation is pushing up rent and property prices in several cities and towns across the continent, making it one of the hottest and most promising places in the world for real estate investment.

The boom in Africa’s real estate market is a juicy opportunity for entrepreneurs to exploit and become successful property owners.

This article explores the reasons for this boom, why you should invest in real estate and five great tips to help you succeed in this market.

What Is Causing The Real Estate Boom In Africa to not only share interesting business ideas and opportunities with you but to explore the reasons behind them. Knowing the reasons why the real estate market in Africa is booming makes you a more informed entrepreneur and allows you to take calculated risks and make better investment decisions.

Some of the factors behind this boom may be obvious to you, but it is very important that you look at them in the right context. Here they are…

#1 – Africa Is Experiencing a Huge Population Boom

Africa’s population currently stands at over one billion and is expected to reach 2.4 billion in just 40 years. Over this period, our continent will experience the fastest population growth in any part of the world (including Asia).

The 10 countries on earth with the highest fertility rates are in Sub-Saharan Africa where the average woman gives birth to about five children in her lifetime.

In countries like Niger, the birth rate is as high as seven. (source: Population Reference Bureau).

Just to give you some perspective, according to a Reuter’s article published early this year, Nigeria (Africa’s most populated country) adds roughly 11,000 newborns to its population every day!

Over the coming years, millions of Africans will need shelter – a roof over their heads. This huge population boom is the strongest underlying reason for the huge demand for accommodation and real estate properties across Africa.

#2 – Millions of Africans are moving to the cities

A significant proportion of the demand for housing and real estate in Africa is concentrated in the cities.

According to a report by the International Housing Coalition, only about 80 million Africans lived in cities in 1983. Today, that number has risen to over 400 million. The size of Africa’s urban areas has been growing at nearly 5 percent for the past two decades.

Going by the current estimates, 300 million more Africans will become city people and urban dwellers by 2030.

A few reasons why Africa’s urban population is growing at such a high rate are its huge population boom, and fast growing economy which is attracting more people to the cities who are searching of job and business opportunities.

At the moment, a little over 50 African cities have a population equal to or more than one million people. At the current rate of migration, the number of cities with over one million people is expected to reach 65 by the year 2030.

Because more people are flocking to cities and towns in search of jobs and a better life, they are putting a lot of pressure on the inadequate accommodation in urban areas.

#3 – The Housing Problem is Too Big for the Governments

In many parts of the world, governments are responsible for providing basic and affordable housing and accommodation for its people. In Africa, however, the governments are not doing enough to solve the housing shortage problem.

In the continent’s most populated country for example, the World Bank estimates that over 16 million new houses need to be provided to solve Nigeria’s serious housing problem. The estimated cost of providing these homes stands at a whopping $350 billion! That’s too much for any one government to handle!

As a result of government’s inability to close the huge gap between supply and demand for housing in Africa, the pressure from the large existing demand is pushing up real estate prices across the continent.

As a result, private investors, entrepreneurs and ordinary people like you now have a role to play in solving the housing crisis.

#4 – Favourable Economic Growth

The recent (2013) report by the African Development Bank, OECD, UNDP and ECA reveals that Sub-Saharan African economies are among the fastest growing in the world. According to the report, “Africa’s economic growth was 4.2 percent in 2012 and is projected to reach 4.5 percent in 2013, and further to 5.2 percent in 2014.”

In times of economic boom, more people have the financial power to invest in real estate. Although there is still widespread poverty in many parts of Africa, the average income per person is growing in many countries.

In addition, the size of Africa’s large and growing middle class is a significant force behind the boom in the real estate market. The people in this category (now more than 300 million) are looking for real estate to live or invest in and have the money to pay.

4 Reasons Why You Should Invest in Real Estate?

Now that we have looked at reasons behind the huge demand and boom in the African real estate market, let’s now look at a couple of reasons why you should be very interested to invest in real estate.

#1 – Real Estate Provides a Steady Source of Cash Flow

With the high demand for accommodation and growing inflation, rent prices are always on the rise. Higher rent prices mean more income for you, the landlord.

Compared to other investment options, the income from real estate is the most steady.

Take stocks for example, the amount of dividends paid by many companies often fluctuate and may not be paid every year. Bank savings (another form of investment) usually attract interest payments that may be steady but are often very small compared to the returns you can get from investing in real estate.

Because the income from real estate investments is steady and predictable, you can plan better.

The rent you get from your property can be used for specific projects such as paying your kids’ school fees, travelling abroad or buying a new car. Rental income is also great for people who are planning for retirement.

#2 – Real Estate Can Be Used As Collateral for a Loan

In Africa, collateral is one of the biggest obstacles faced by entrepreneurs in obtaining a bank loan to start a new business or acquire property (such as a factory, machinery or equipment).

When banks ask for collateral, they want you to provide something that is equal to or greater in value than the loan amount you are asking for. Under this definition, your car and furniture should qualify as collateral, but the banks won’t accept them.

Banks usually prefer real estate as collateral because it is known to continually appreciate in value. Unlike your car which loses value every day, the value of real estate properties are more likely to grow.

Compared to stocks (which some banks accept), the value of a property cannot vanish overnight (like stocks). As a result, an investment in real estate means that you can use the properties you buy as leverage to get money (loan) from a bank and other lenders. Only very few other investments can give you the kind of leverage that real estate can.

#3 – Real Estate Offers One of the Highest Returns on Your Investment

Like we just mentioned, real estate always grows in value. Especially in developing regions like Africa where the property market is not as matured like in North America or Europe, the prices of real estate are often on a steady rise.

Nairobi (Kenya), Lagos (Nigeria) and Luanda (Angola) are some of the African cities that are currently rated as hot property markets. Due to the huge demand for shelter in many African cities, the returns on real estate investment are one of the highest in the world.

Although buying and selling of real estate should not be your main investment goal, it is your insurance that should you need to sell your property sometime in the future (for whatever reason), you will still make a handsome return.

You can earn rent income for many years like we mentioned earlier or you could sell the property. Either way, you make money and earn a profit on your real estate investment!

Nigeria is one of the many countries in Africa that is experiencing a huge boom in its real estate market. The short 2-minute video you are about to watch is just another account of the huge returns that are possible with real estate investment. In two of its major cities, Lagos and Abuja, returns as high as 35 percent are being achieved. Watch and get inspired…

#4 – Real Estate is a Low Risk Investment

I’m sure you would have heard of stock market crashes and banks going bankrupt. Although real estate values often fall, it is not usually a very bad situation. In fact, even when property values fall, you would still earn rent income from your property.

On the other hand, real estate is physical and tangible compared to stocks, bonds and many other intangible forms of investment. Both in times of high inflation, economic boom and bust, real estate investments remain robust and will most likely continue to earn you income.

Very few other investment options can do the same.

How to Invest In Real Estate in 5 Easy Steps!

To us, it is not just enough to tell you about the juicy opportunities that exist in Africa’s real estate market. Knowledge alone is not enough.

Because we believe the key to entrepreneurial success lies in action, we shall share with you some very important tips about investing in African real estate. Here they are…

1. First, Set Your Investment Goals…

Like we mentioned before, there are two main ways to make money from any real estate you buy: sell at a higher price or rent (or lease) it to earn steady flowing monthly/yearly income.

Which of these will be your goal? What’s your plan?

Are you planning for retirement and need a source of income to sustain you when you are no longer working?

Do you plan to quit your job one day to pursue your real passions but need a regular source of income other than a job?

Maybe you really don’t need a steady income. It could be that you are looking for low risk and long-term investment opportunities that appreciate in value over time and give a better return. You want something with investment returns that are better than a savings account and more predictable than stocks.

Whether your plan is to buy, keep and sell later or to earn steady rent income, it is very important that you have a plan and stick to it. This is the first and most important thing to do before investing in real estate.

2. Who to Buy From And How to Find Them

The main player in the public group is the government. Governments often sell real estate to ordinary people and companies for residential or industrial development.

When governments sell real estate, it usually sells at a lower price compared to the prevailing market prices.

Government housing estates are a good example of a real estate opportunity where ordinary people can buy and own housing units (single homes, duplexes etc) at below market prices.

The private group is primarily made up of individuals and corporate organisations.

If you look in the classifieds section of your local newspaper, you are likely to find adverts for real estate properties on sale.

People are always on the market to sell property for all sorts of reasons. Maybe it’s land that they inherited which they want to sell or it could be that they have an urgent need for cash. Other times, sellers could just be investors like you who want to realize their profit/investment.

There are always a wide variety of properties on the market for sale – bare land, partially-completed buildings, old properties that need to be renovated and brand-new (finished) houses. Depending on their condition and location (developed or undeveloped parts of town), the prices will vary significantly.

How can I know of these opportunities you ask? Well, there are a couple of tips we would share with you in this regard. And they are:

- Be observant and pay more attention to your environment. Look out for all those ‘For Sale’ banners that often hang on properties that you have been blind to all along. For all you know, there may be a juicy real estate deal on your street that you haven’t noticed.

- Follow real estate ‘For Sale’ listings and adverts in newspapers and magazines. This is the traditional way for sellers of real estate to find buyers. In some cities, there are newspapers and magazines that carry only real estate news and listings. Most of these listings describe the properties, the seller’s asking price and a phone number you can call. Easy and convenient!

- Ask around. Let people know you are in the market looking for properties to buy. Your neighbours, office colleagues and friends can be rich sources of real estate information. All you have to do is ask!

- Enlist the services of a real estate agent. These agents are professionals who help ordinary people like you find the kind of properties they want. Whether you want a property to live in or as an investment, it’s their job to find it for you, and of course, earn a commission for their services. It’s a win-win for both you and the agent. We did a previous article dedicated to the real estate agency business.

3. Before You Buy, Do Your Research Very Well!

There is a lot of real estate fraud going on and you need to be sure that you are buying from the right owner of a piece of property.

You must be sure of the correct condition of any piece of real estate you are interested in.

Depending on your location, there is often a way to verify the ownership title of every property.

Most cities have a Land Registry with records that contain up-to-date information about every kind of real estate in the area. Your lawyer would definitely know about this. Pay him/her to obtain a report from the relevant government department.

This is one of the most important but often overlooked things inexperienced real estate investors never do.

Most times, there are important pieces of information that you may be unable to get from formal or government sources.

Ask around the area for any things you may be missing. There may be softer issues about the property that may reduce (or improve) the value of your investment.

For example, if there are frequent security threats in the neighbourhood (like robberies, kidnapping etc), it may discourage tenants from your property and likely reduce its value should you plan to sell it in the future.

4. What If You Don’t Have The Money?

Many people think they need to have a truck load of money before they can invest in real estate. In fact, we often wrongly believe that the property market is reserved for rich people and large companies who have deep pockets.

This is so not true.

Like every other business or investment that exists, there is room for everybody in real estate, no matter the size of your capital.

As we always advise, start small.

Start with your savings. Set a target for yourself every year to set some money aside for real estate investment. It may take you months or a couple of years to save enough money to buy a piece of property.

Start with what you can afford. Start with empty parcel of land on the outskirts of a developing and expanding city. These are usually cheaper than properties in developing areas but the potential for high returns is huge.

Apart from using your savings as a source of capital, there are a couple of other interesting ways to raise the money you need to start investing in real estate.

5. Make Sure You Get the Necessary Titles and Government Approvals

Due to poor regulations and inadequate controls, real estate scams are rampant in many of the cities with hot property markets in Africa.

There are incidences of fraud where the same piece of property is sold to several people. This is just one example of the different kinds of fraud and scams you could become a victim of if you are not careful.

After you have paid for any piece of real estate, you should ensure that you register your ownership (or ‘title’ as it is legally known) with the appropriate government office or department. Your lawyer can advise you on the relevant registrations and approvals to obtain.

After successfully purchasing property or real estate, many people ignore this very important step. By the time they wake up to the realities of the situation, it may have become too late.

By registering your title and getting the necessary approvals, the government recognizes your ownership of the property and protects you from any fights or disputes that often show up in this part of the world.

Getting your title registered may cost you some money and effort but it is usually worth it in the long run. Investing in good real estate is not enough. You have to do what it takes (legally) to protect your investment.

Now you know how to invest and make money in real estate in Africa…

Investing in real estate is usually a long term journey; the rewards and profits take time to accumulate and the impact on your finances grows over time.

Time is the only element of real estate investing that you don’t have. This is why the best time to start is NOW!

It’s never too early to start. Like we advised early on, start keeping away some money every month as savings to buy a piece of property.

Set a target for yourself at the beginning of every year to invest in real estate. Get hungry for real estate deals and information. Start working on your ‘property hunting’ and negotiation skills. Since real estate investments need time, the best time to start is today!

In this article, we have looked at the situation of the real estate market in Africa and the many opportunities that lie within it. We have also explored the strong reasons why you should consider investing in real estate and five great tips that will help you succeed.

We believe that all the opportunities we have shared with you in this article will be taken further by your creativity and energy.

Please leave a comment, share your views and ideas or ask any questions you may have concerning real estate investing in the Comments section below.

We would also appreciate that you share this article with your friends using the Facebook, Twitter and Google+ buttons below. You never know, you could inspire and change somebody’s life today!

To your success!