Business

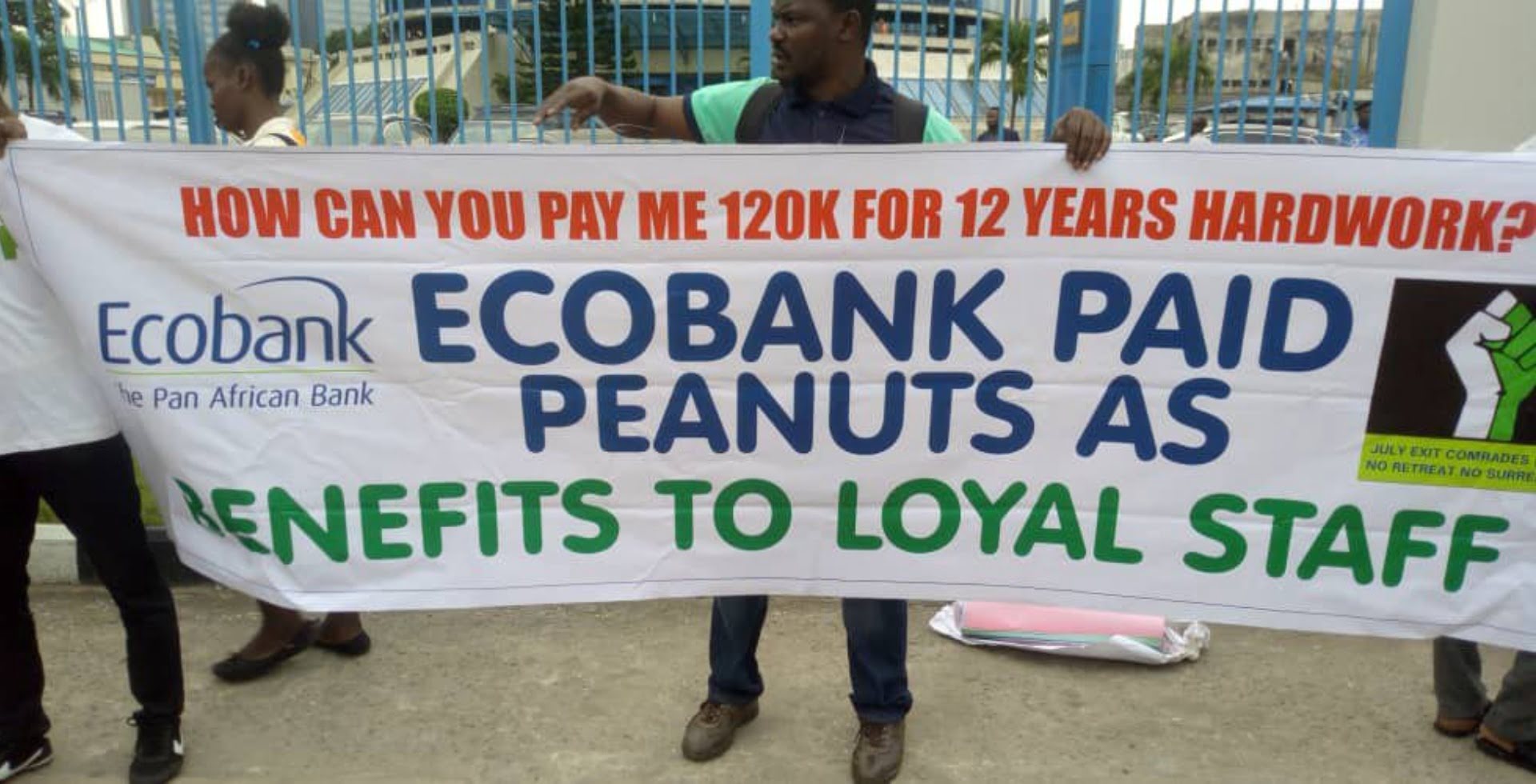

Ecobank workers protest inadequate severance pay

Over 150 Ecobank employees in Nigeria are expressing outrage over what they describe as inadequate severance pay following their abrupt termination on December 22, 2023.

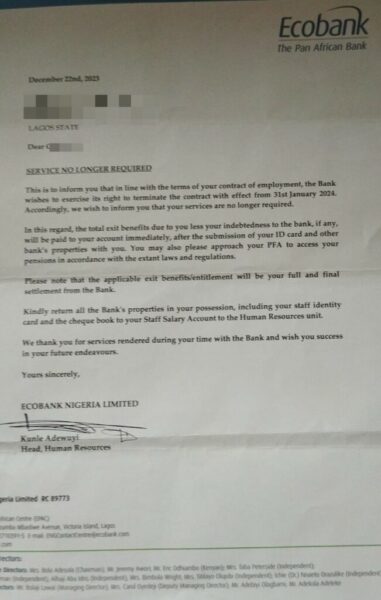

The affected workers, who had served the bank for 10 to 22 years, were given their termination letters on December 22, with the termination officially taking effect on January 31, 2024.

On that day in December, Ecobank disabled these workers on its intranet system and paid them their old salaries for the month. Meanwhile, unaffected staff received salary increases.

In February, the severance pay provided to the terminated employees was a fraction of what they expected. Despite their long years of service, they received only four months’ net salary instead of the anticipated one-year gross salary. For example, an employee expecting N10 million got just N2.5 million.

Read Also:

Man narrates how over N700,000 disappeared from his Ecobank account

Many of these workers ended up with little to no severance pay after the bank deducted outstanding loans from their severance packages.

Some even found themselves with a debit balance, forcing them to find additional funds to clear their debts.

One worker, whose severance pay was N2.8 million, received only N600,000 after a loan deduction of N2.2 million.

“The severance pay was poor and unfair,” said an affected worker. “We were only paid a mere four-month net salary, not even the gross salary. An assistant manager with a gross annual salary of N10,178,000 and a net monthly salary of N644,000 was paid ex gratia of N2.5 million.”

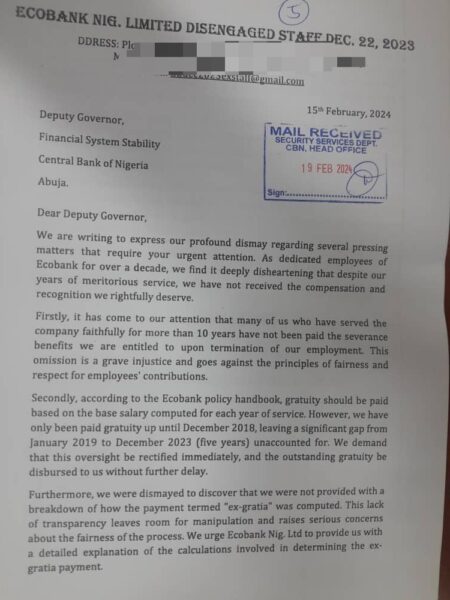

The severance payment process has been criticized for its lack of transparency. The criteria for the one-month in lieu of notice payment were unclear, and deductions made from the usual one-month salary resulted in varying percentages of the expected amount.

Displeased with the compensation, the terminated employees wrote to Jeremy Awori, CEO of Ecobank Transnational Incorporated, but received no response. The Association of Senior Staff of Banks, Insurance, and Financial Institutions (ASSBIFI) has been negotiating with the bank, but no satisfactory resolution has been reached. The union has also contacted the Ministry of Labour, awaiting a response.

Months after their disengagement, the affected workers are still struggling to find new employment and financial stability. Despite reaching out for further comment, there has been no official response from Ecobank’s management.

“Most of us have been facing a lot of financial mess since the beginning of the year,” another worker said. “We want the management of the bank to do the needful.”