Business

CBN raises interest rate to 26.75 per cent amid inflation concerns

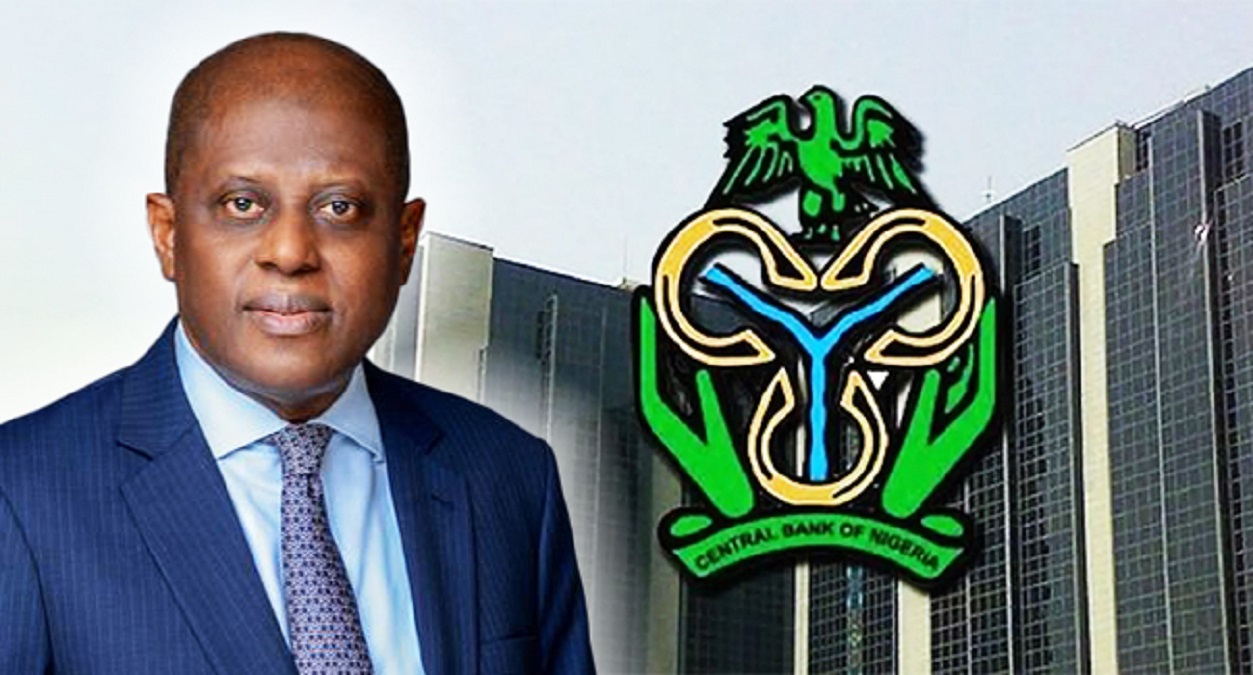

The Central Bank of Nigeria’s (CBN) Monetary Policy Committee (MPC) has increased the baseline interest rate by 50 basis points to 26.75%, announced Governor Yemi Cardoso at the committee’s 296th meeting on Tuesday.

The MPC also adjusted the asymmetric corridor around the Monetary Policy Rate (MPR) to +500/-100 basis points and maintained the Cash Reserve Ratio (CRR) for commercial banks at 45%. Additionally, the CRR and Liquidity Ratio for merchant banks remain at 14% and 30%, respectively.

Governor Cardoso, also the MPC Chairman, stated that the meeting, attended by 11 MPC members, reviewed recent economic and financial developments and assessed risks to the outlook. The committee was particularly concerned about rising prices affecting households and businesses and emphasized its commitment to controlling inflation.

“The MPC re-emphasized its commitment to the CBN’s price stability mandate and remained optimistic that despite the June uptick in headline inflation, prices are expected to moderate in the near term,” Cardoso said. This optimism is based on the traction of monetary policy and recent fiscal measures to address food inflation.

The committee noted the persistence of food inflation, which undermines price stability. Rising food and energy costs, prevailing insecurity in food-producing areas, and high transportation costs of farm produce were identified as contributing factors. The MPC recognized the need for urgent solutions to these challenges to offer sustainable relief from food price pressures.

The committee also addressed the increasing activities of middlemen who finance smallholder farmers, hoard produce, and move it across borders, exacerbating the food supply deficit. The MPC suggested measures to check these activities to stabilize domestic food prices.

“The MPC resolved to sustain collaboration with the fiscal authority to ensure that inflationary pressure is subdued,” Cardoso stated. The committee expressed optimism about the Federal Government’s recent measures, such as the 150-day duty-free import window for food commodities, which aims to moderate domestic food prices without causing further inflation.

Furthermore, the MPC noted positive developments in the foreign exchange market, including the narrowing spread between various segments, indicating improved market efficiency. The increase in external reserves was seen as a confidence booster for a more stable exchange rate. The committee urged the CBN to explore avenues to improve inflows, especially through diaspora remittances.

Cardoso also highlighted efforts by the Federal Government and the private sector to enhance domestic refining capacity, which is expected to reduce the foreign exchange spent on importing refined petroleum products.

The MPC’s decisions reflect a strategic approach to navigating the current economic challenges while fostering a stable and prosperous economic environment in Nigeria.