NEWS

BREAKING: Charlie Javice, College Fintech Startup’s Founder Charged in $175M Fraud

The world of finance and technology is no stranger to scandals, but the latest news of fraud and deception by the founder of Frank, Charlie Javice, has left many feeling emotional and betrayed.

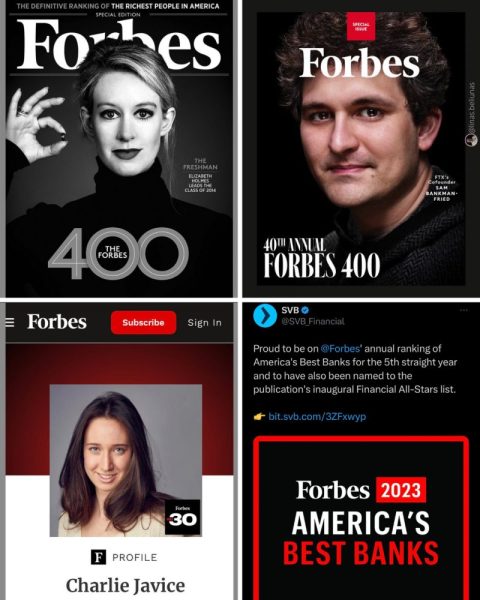

The 30-year-old entrepreneur, who was once a proud member of the Forbes 30 Under 30 list, is now facing up to 30 years in prison for her alleged role in defrauding banking giant JPMorgan of $175 million. She faces more than 100 years in jail if convicted.

Frank was launched in 2016 as a financial platform to help college students manage their financial aid and student debt. Javice had a grand vision of turning Frank into “an Amazon for higher education.” However, it seems that in her quest for success, she resorted to unethical practices that have now cost her dearly.

Javice’s downfall began when she tried to scale Frank by creating 4 million fake customer accounts. When a top engineer at Frank refused to create the fake accounts, Javice approached a data science professor to help. Using data from some individuals who had already started using Frank, he created the fake accounts for which Javice paid him $18,000.

The fake customer accounts looked like the next big thing, and JPMorgan was keen to acquire it. However, the bank soon realized that something was amiss when a JPM employee noticed that the list contained exactly 1,048,576 rows, the maximum allowed by Microsoft Excel. When the bank spammed the 4 million fake accounts with cross-marketing opportunities, nearly all bounced back, revealing that the customers were fabricated.

JPMorgan Chase immediately shut down the site and sued Javice. Now, the SEC has filed a complaint against Javice, alleging that she orchestrated a scheme to deceive JPMorgan into believing that Frank had access to valuable data on 4.25 million students who used Frank’s service when, in reality, the number was less than 300,000. The SEC’s investigation shows that, as a result of the eventual $175 million acquisition of Frank, Javice received $9.7 million directly in stock proceeds, millions more indirectly through trusts, and a contract entitling her to a $20 million retention bonus as a new employee of JPM.

Javice’s actions have not only led to legal consequences but also emotional turmoil for those affected by her actions. College students who trusted Frank to manage their finances and debt are now left wondering if their personal information was compromised. Investors who believed in the potential of Frank have lost millions of dollars. And JPMorgan, one of the largest banks in the world, is left reeling from the embarrassment of being defrauded.

The aftermath of Javice’s fraud has left many questioning the ethics of the FinTech industry and the role of startups in society. The scandal has highlighted the need for greater transparency and accountability in the industry and has left many wondering how they can trust their financial information to startups and FinTech platforms in the future.

The downfall of Charlie Javice and the Frank scandal serves as a cautionary tale for all entrepreneurs and investors. It is a reminder that shortcuts to success come at a high cost and that unethical practices have no place in the world of finance and technology. As the industry continues to grow and evolve, it is up to all stakeholders to ensure that trust, transparency, and accountability remain at the forefront of their operations.

The news of Charlie Javice, Elizabeth Holmes, and Sam Bankman-Fried being accused of fraud and deception has brought to light the issue of ethics and accountability in the world of entrepreneurship and business. The Forbes 30 Under 30 list has long been considered a prestigious honor for young achievers, but the recent scandals involving some of its members raise questions about the vetting process and the standards used to select the honorees.

It is clear that the success and innovation of startups and entrepreneurs should not come at the expense of ethical and legal standards. The scandals involving Javice, Holmes, and Bankman-Fried are a reminder of the importance of transparency and accountability in business, and the need for stricter regulation and oversight.